Business success relies heavily on “knowing your numbers.” Controllers oversee the accounting department and make sure that all accounts are properly looked after. This role is an integral part of the company; without accurate financial records, your executive team can’t make wise decisions about your company’s future. You can’t afford to take any chances when hiring a controller. You need to have the right person in place.

The controller position requires intricate knowledge and a highly refined skill set in finance. For this reason, hiring managers will often choose a candidate based on their education, experience, and a good gut feeling.

However, while trusting your gut might seem like a decent way to make a hiring decision, it’s not the way to ensure you’ll end up with the best person for the job.

Here’s why:

What you’re looking for can’t be found on paper. The ins and outs of this role are learned through years of experience, that’s true. It’s easy to think that because someone looks good on paper or has the requisite experience, they’re a good fit for the role. But interviewing for the finer points of the role—including people management and the ability to communicate financial details to executive team members—makes finding the right controller much more difficult.

You can’t afford to hire the wrong person. According to the Society for Human Resource Management, it takes an average of 42 days to fill a role and costs about $4,129 per hire, not including the lost opportunity cost during the time the role was vacant. Add to that the cost to interview and train a new employee, and you can see why making the right hire is paramount to your business’s long-term success.

With that in mind, how can you find top-performing controllers? Here are four places to start:

1. Define the skills and experience the controller role requires.

From overseeing internal control audits to managing the monthly, quarterly, and annual financial accounts, there are certain skills a controller needs to know how to do. Depending on the size of your organization and whether or not you have a CFO, the roles and responsibilities may vary. Make a list of what you need your controller to do for your organization.

When it comes to basic skills, a controller should be able to:

- Serve as the go-to liaison between the accounting team and the executive team

- Manage the accounting team and work with them to streamline processes

- Prepare the company’s financial reports and an analysis of future earnings and expenses

- Demonstrate a strong grasp of industry regulations

Besides this baseline skillset, which other traits are important to you? For example, are you a rapidly growing organization? Do you require this person to work at a faster-than-average pace? Make sure you get your team’s needs down on paper and share them with the hiring manager.

2. Focus on traits and behaviors over skills and experience.

What makes a controller great is not just their ability to perform their job functions exceedingly well; it’s also the soft skills and organizational skills they possess that allow them to succeed in the role.

Some of the common traits and behaviors exhibited by top-performing controllers are:

- Strong organizational skills

- Close attention to details

- Trustworthiness

- Excellent communication skills

- Collaborativeness

- Great at synthesizing information

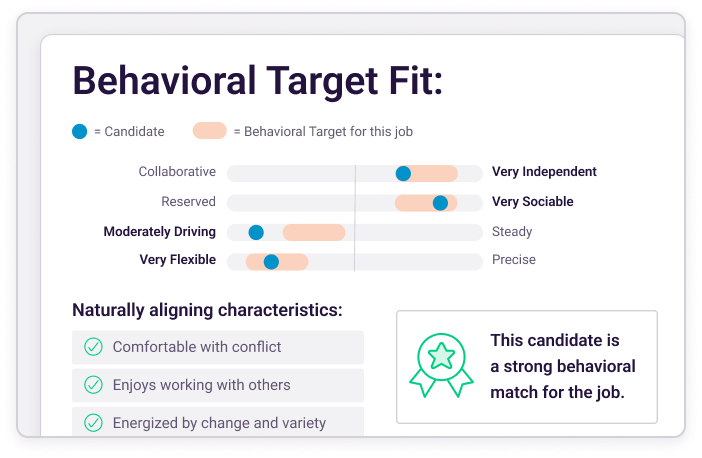

Before you hire, you should know exactly what behaviors you’re looking for. At The Predictive Index®, we recommend that hiring managers create a Job Target. A Job Target is a profile you build through a quick assessment survey. It isolates the precise behavioral traits and cognitive ability a person needs to succeed in a role, which then serve as a guide for interviewing and assessing candidates.

3. Use science and smart hiring practices.

As we mentioned earlier, it can be costly to make a hiring decision based on gut feel. Luckily, making the wrong choice is avoidable. Once you’ve defined what an ideal candidate looks like and put together your Job Target, ask all candidates to complete a behavioral assessment and a cognitive assessment as part of the initial application. Then compare their results to your Job Target and you’ll have your shortlist of candidates to interview.

Our scientifically-validated PI Behavioral Assessment™ identifies individuals’ innate behavioral drives. After a candidate takes the assessment, we assign them a Reference Profile, which shows us the employee’s strengths and helps ensure job fit.

4. Be aware of hiring biases.

Unconscious biases often find their way into the hiring process, whether we mean for them to or not. By implementing strategies aimed at decreasing the risk of bias, such as incorporating objective science in the form of behavioral or cognitive assessments, you can ensure you’re hiring the best possible candidate for the role.

3 most common Reference Profiles for controllers

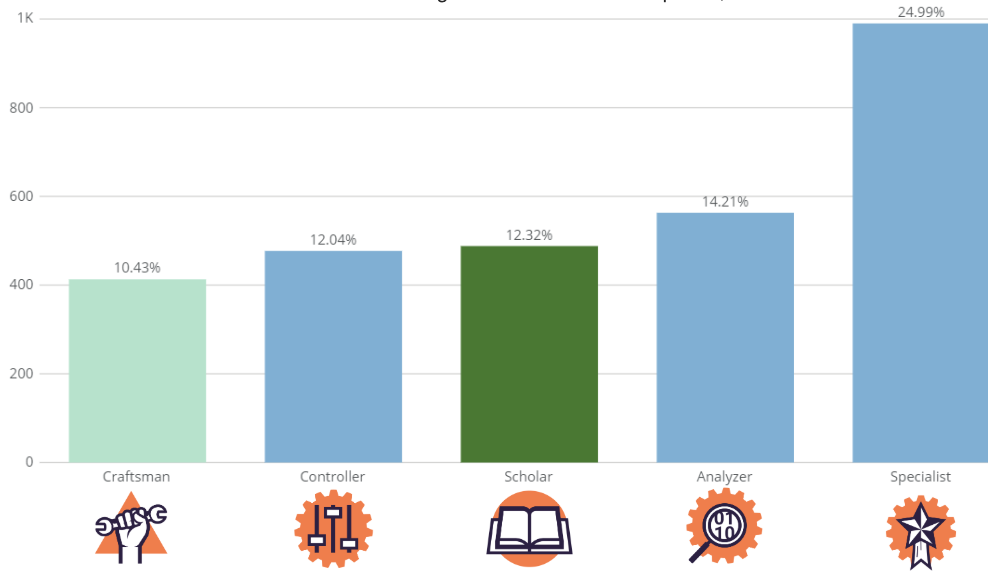

Employers have created nearly one million Job Targets in our system, and 4,000 of them were for controllers. When we look at those Job Targets, we see a few Reference Profiles show up time and again, including:

Specialist

The Reference Profile we see most frequently associated with this Job Target is that of the Specialist. Analytical by nature, they are a natural fit for a role that requires the precision the controller’s job does. Specialists can be trusted to pay close attention to detail and to follow the policies and procedures that are in place. While this Profile tends to be more introverted, they are skilled at collaborating and thoughtfully communicating information.

Analyzer

Another common Reference Profile for this position is the Analyzer. Analyzers are sticklers for details and have little patience for errors, making them a perfect fit for the controller role, which requires them to oversee internal audits and maintain accurate financial records. While it may take them a while to trust a team member enough to delegate, their close follow up will ensure that all accounting done within your organization is done to excellence.

Scholar

True to their name, Scholars seek a high level of technical expertise in their field. This inclination lends itself toward the controller position, as does a Scholar’s risk aversion and methodical nature. Not at all intimidated by reporting, Scholars thrive on compiling data and analyzing it, and their authoritative communication style allows them to confidently interact with executive team members when sharing financial reports.

Though these three Reference Profiles share similar traits, such as close attention to detail and taking time to thoughtfully consider options before making a decision, they each bring something different to the table. While Specialists and Analyzers are both analytical profiles, Specialists are more collaborative whereas Analyzers are more driving. Scholars are much more independent and desire a more steady and stable working environment. There’s no best choice when it comes to which profile you should hire—it all depends on what your organization needs.

Join 10,000 companies solving the most complex people problems with PI.

Hire the right people, inspire their best work, design dream teams, and sustain engagement for the long haul.

How to attract high-performing controllers

All three types are very cautious, which can make it difficult to find and recruit the right candidate. Here are some tips for attracting Specialists, Analyzers, and Scholars to your open position.

Craft the right job listings.

Specialists, Analyzers, and Scholars are analytical—they like to have all the facts. They will be looking for a job description they know they can succeed in, so be sure to be specific in your job posting about expectations, responsibilities, and necessary qualifications.

You might also include some of the adjectives from the Reference Profile summary after you complete a Job Target. If a candidate matches the Reference Profile you’re looking for, they will be drawn to the descriptors used to describe the position.

Here are some bullet points you can copy and paste:

Key responsibilities:

- Manage all accounting operations, including quality control of all financial operations

- Prepare the budget, financial forecasts, and report variances

- Coordinate and publish regular reporting and monthly financial statements

- Manage and comply with local, state, and federal government reporting requirements and tax filings

- Develop and document business processes and accounting policies to maintain and strengthen internal controls

Additional responsibilities, if no CFO:

- Oversee all financial operations within the organization

- Identify business risks and advise executive team on solutions to mitigate risk

- Create long-term forecasts

- Advise on mergers, acquisitions, and other financial decisions

Desired experience:

- Minimum 5-8 years of accounting and finance experience

- Bachelor’s degree or higher in Accounting

- Knowledge of payroll, accounts payable, and accounts receivable functions

- Thorough understanding of local, state, and federal tax laws

- Excellent computer skills, especially in Excel and accounting software

Check your employer brand.

All three of these types are risk-averse. Before they apply to work with you, they’ll be doing their research on your company. What’s the company’s reputation? What do people have to say on Glassdoor about the company’s culture and policies?

Try to get a referral.

In most cases, the best way to find a controller is by connecting with your employees and your own network to see if they know of anyone who would fit the bill. While introverted by nature, each of these types tends to stand out for quality work and incredible accuracy, making them easy to spot and remember. Once you have your referral, just make sure your procedures and systems are in place for a smooth onboarding process!

Make the right job pitch.

Interviews are about more than just fact-checking qualifications and asking questions. They’re also about winning over top talent. To win over these three cautious types, focus on the technical aspects of the job and opportunities for professional development. Make sure to discuss aspects of your company culture, so they can get an understanding of what to expect. Analytical profiles, like the Specialist and Analyzer, perform better in startup or leaner environments, where there is more of an opportunity to work at a fast pace. Scholars, on the other hand, prefer larger companies that have a steady, more stable working environment.

Onboard them well to retain them longer.

Signing new employee paperwork isn’t the end of the hiring process. Especially for these Reference Profiles, it’s important to give them thorough, clear, and specific instructions on how to succeed in the role. For the more independent and driving personalities—your Analyzers and Scholars—set them up in your project management software and lay out week by week what you need from them. For the more collaborative Specialist, you can take it a step further by scheduling appointments on their calendar and coordinating trainings with key members of your team.

You may also find it helpful to give them their PI profile, personal development chart, and placard, so they can learn more about The Predictive Index and how to excel in their role.

Don’t leave hiring to a gut feeling.

Try our free Job Benchmarking Calculator to discover the most common Reference Profiles for any position in your company.