CEO Benchmarking Report

CEOs reveal what keeps them up at night

Introduction

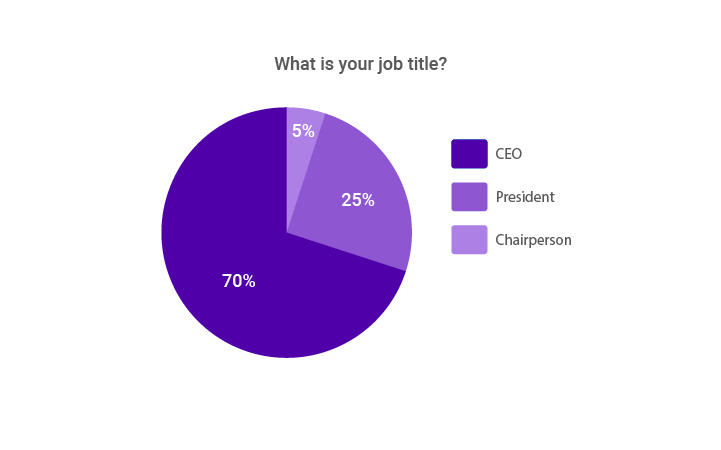

In January of 2019, The Predictive Index™ surveyed 156 CEOs, presidents, and chairpeople. We asked a slew of questions that cut to the heart of what drives them, what their challenges are, and what keeps them up at night. Their answers revealed the patterns of high-performing CEOs and allowed us to explore the executives’ inner thoughts and biggest weaknesses.

We’ve broken our findings down to four sections:

Section 1

CEO top priorities, challenges, and anxieties

CEOs’ #1 priority

We begin by looking at the issues that consume CEOs. What are their biggest priorities and biggest challenges? As you’ll see, strategy and talent are top of mind.

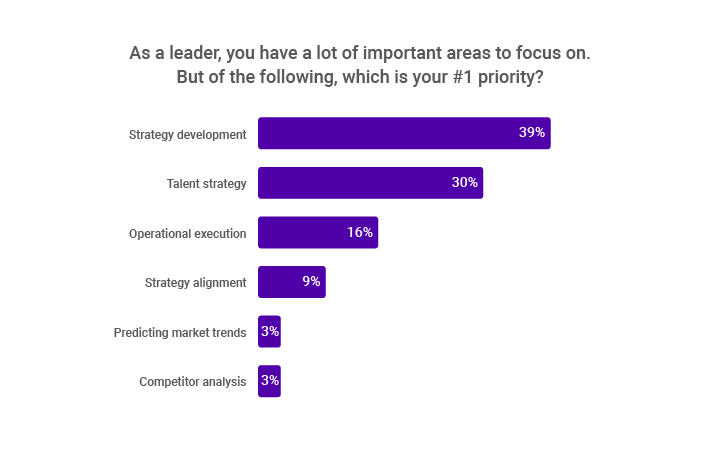

We asked our panel of 156 CEOs to identify their single biggest priority. The data tells us strategy and people come first—and then there’s everything else.

KEY FINDING

Strategy development and talent strategy are CEO top priorities.

Biggest challenges

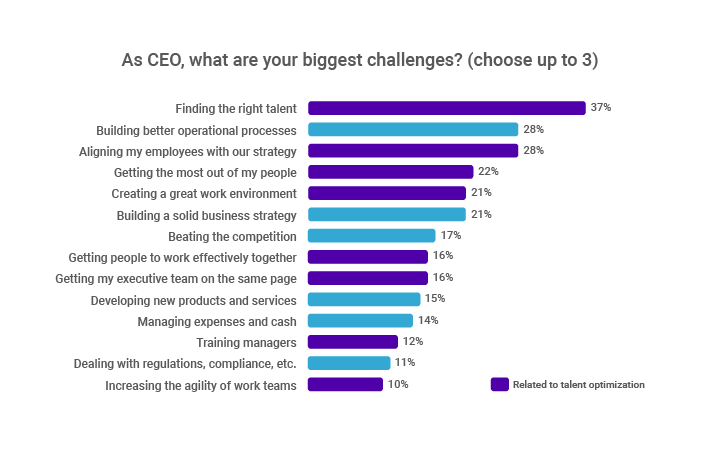

We also asked CEOs to identify their top three challenges, and a distinct pattern emerged. The majority of their top challenges map back to people strategy and talent management; and their #1 challenge is finding the right talent. (In the chart to the left, all talent optimization challenges are highlighted in purple.)

KEY FINDING

Four of the top five biggest CEO challenges relate to talent optimization.

People costs

CEOs’ fixation on optimizing their talent makes sense—not just on an emotional level, but also on a financial level. In fact, if left unchecked, by 2030, the talent shortage could result in about $8.5 trillion in unrealized annual revenues (Korn Ferry). So there’s the ubiquitous reality that “our people are our most valuable asset,” and here’s another truism:

People are most companies’ biggest expense.

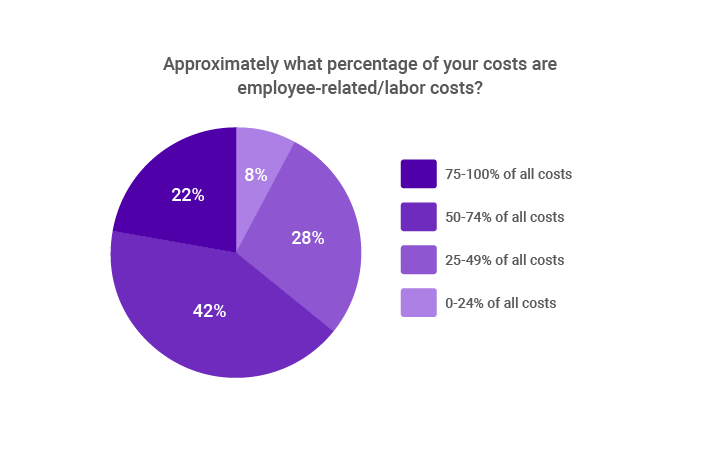

We asked the CEO panel what percentage of their total costs are employee-related. For 63 percent of companies, employee-related costs constitute at least half of their overall costs.

On average, employee-related costs make up 55 percent of total company costs.

Talent strategy

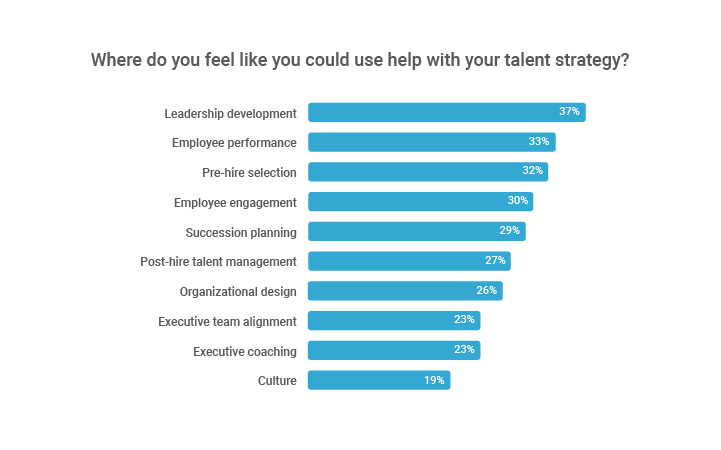

Given what a big challenge (and cost) talent is for organizations, we wanted to understand where CEOs feel they need help when it comes to talent strategy. Simply put—they need help across the board. Their top three answers were leadership development, employee performance, and pre-hire selection.

KEY FINDING

CEOs need help developing leaders, managing employee performance, and leveraging pre-hire assessments—i.e., talent optimization activities.

Section 2

Analysis of CEOs at high-performing companies

Goal achievement

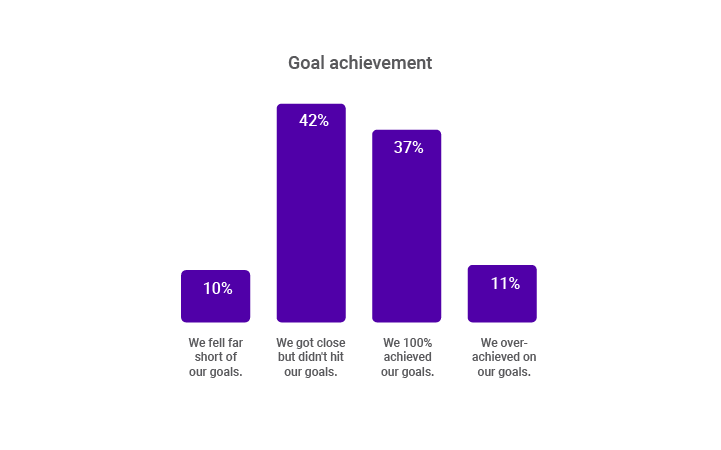

We were curious to know about the performance of the CEOs we surveyed, so we asked them to reveal how they performed against their 2018 goals. In our sample, 145 (93 percent) CEOs reported that they set goals in 2018, and more than half fell short of their goals.&

KEY FINDING

52 percent of the CEOs who set goals in 2018 didn’t achieve them.

What keeps them up at night

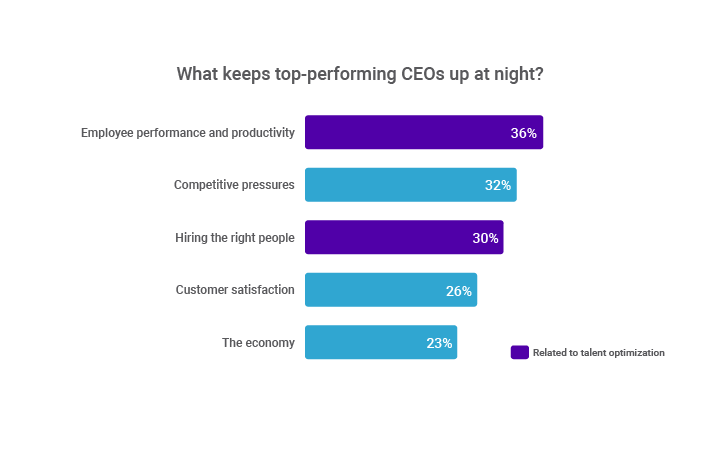

We then analyzed the responses of high-performing CEOs (those who met or exceeded their 2018 goals) to infer what makes them successful.

What keeps successful CEOs up at night are these three issues: employee performance and productivity, competitive pressures, and hiring the right people.

In the chart, N = 69, representing CEOs who were designated as “top performers” based on achieving 100 percent or more of their goals in the 2018 calendar year.

All talent optimization challenges are highlighted in purple.

In the chart, N = 69, representing CEOs who were designated as “top performers” based on achieving 100 percent or more of their goals in the 2018 calendar year.

KEY FINDING

Two of the three top factors keeping high-performing CEOs up at night are people problems.

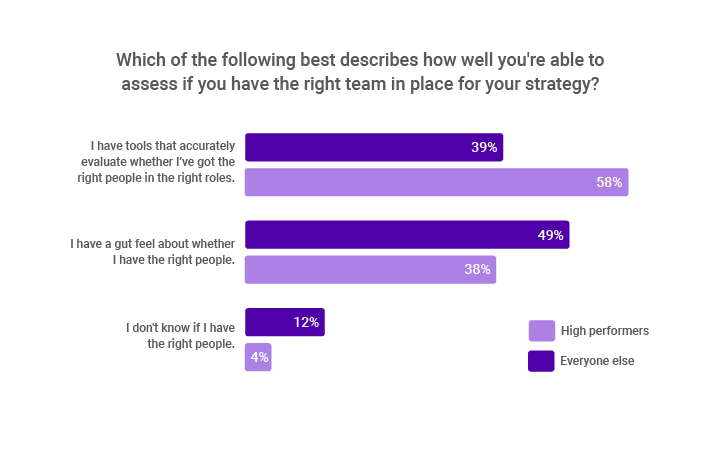

We thought it would be informative to look at how high-performing CEOs assess their teams relative to other CEOs. As it turns out, they are far more likely to implement tools that help them evaluate whether they have the right people in place, and they’re less likely to go off gut feel.

KEY FINDING

58 percent of high-performing CEOs use tools to assess job fit and team fit.

Glassdoor ratings

We wondered how employees felt about working at high-performing companies. A good proxy for understanding employees’ perceptions of their companies is to look at Glassdoor ratings.

As it turns out, there was an undeniable correlation between company goal achievement and high Glassdoor ratings. Yet it’s hard to say from our survey data whether strong performance leads to higher Glassdoor ratings, or higher Glassdoor ratings lead to higher performance.

In the chart, N = 79, representing data from CEOs who set goals in the 2018 calendar year and whose company had a Glassdoor employee review rating. Additionally, the correlation between the Glassdoor rating and achievement of goals was r=0.24 (p<0.05, pearson 2-tailed correlation).

KEY FINDING

High-performing companies had better Glassdoor ratings than those who fell short of their goals.

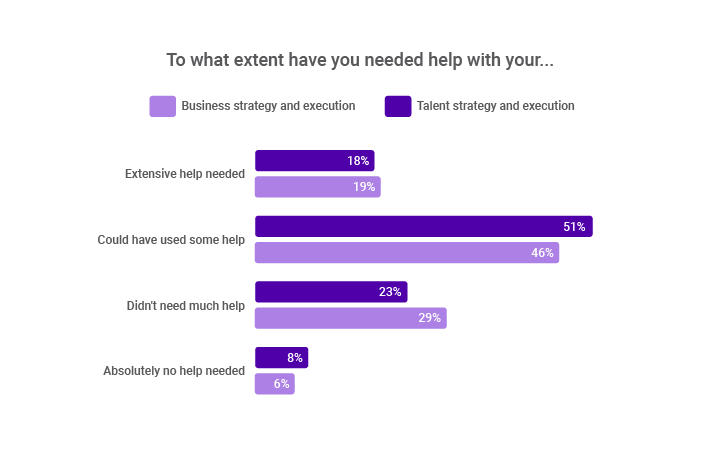

Where they need help

We asked all CEOs whether they needed help with business strategy and execution or talent strategy and execution in the past five years. The majority needed help on both fronts.

KEY FINDING

Nearly 70 percent needed help with talent strategy and execution; 65 percent needed help with business strategy and execution.

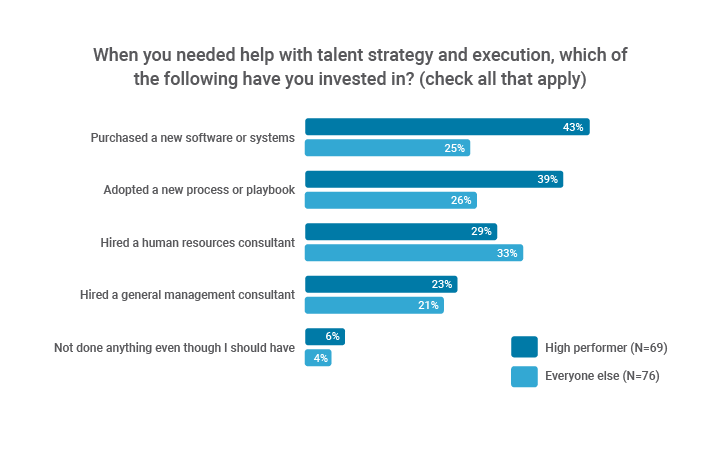

Where they invest

But when it comes to talent strategy and execution, high-performing CEOs are much more likely to have purchased new software or systems or adopted a new process or playbook than other CEOs.

In the chart to the left, total N=145 (69 top performers, who hit or went over their 2018 goals, and 76 non-top performers, who did not achieve their 2018 goals), representing CEOs who set goals for the 2018 calendar year.

KEY FINDING

High-performing CEOs leverage new software, systems, processes, and playbooks to solve their people problems.

Section 3

CEOs’ biggest weaknesses–and what else they’re secretly thinking

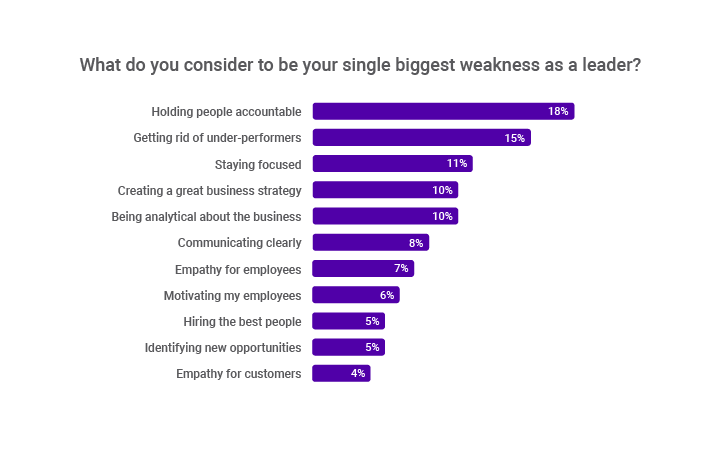

Biggest weaknesses

We wanted to get inside the minds of CEOs and understand their own self-perceptions.

We were curious about what they considered their greatest vulnerabilities to be, so we asked them to identify their single biggest weakness as a leader. Considering the top two responses, it appears that even CEOs find it hard to hold the line with employees.

KEY FINDING

CEOs biggest weakness is holding people accountable.

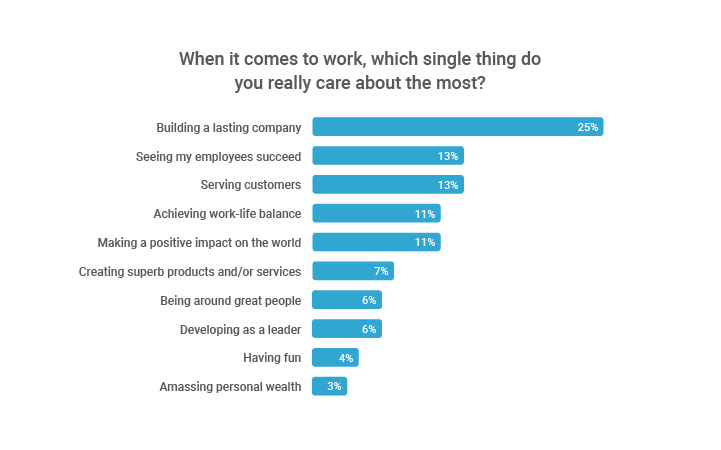

Priorities

Another topic we wanted to understand was CEOs’ ultimate motivational drivers. The number one answer (of the 10 options provided) was building a lasting company; the least-selected answer was amassing personal wealth.

KEY FINDING

CEOs aren’t in it for the money; they care about creating a company that lasts.

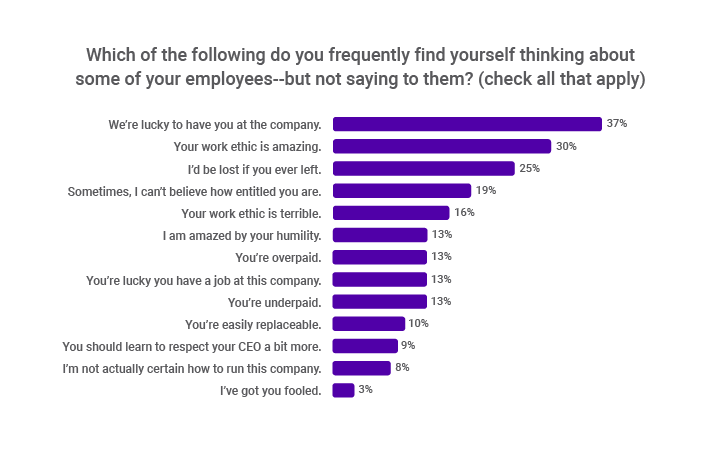

The thoughts they harbor

We also wondered what CEOs really think about their employees—but don’t necessarily say to them. It turns out that most of those thoughts are more likely to be positive than negative.

KEY FINDING

CEOs generally think positively about their employees, but don’t necessarily share their thoughts.

Self-ratings

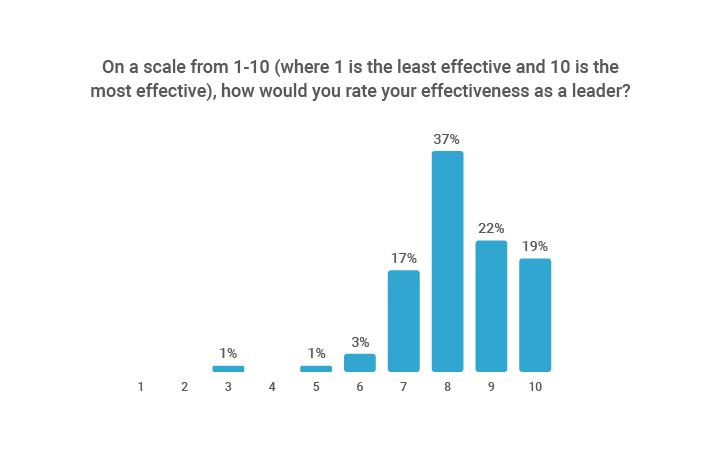

The general perception of CEOs is that they’re confident and self-assured. We tried to validate that perception with data by asking the following question: “On a scale from 1-10 (where 1 is least effective and 10 is most effective), how would you rate your effectiveness as a leader?”

Indeed, the stereotype of CEOs having confidence seems to match reality. The average score CEOs gave themselves in terms of their own leadership effectiveness: 8.25

KEY FINDING

78 percent of CEOs rate themselves an eight or above for their leadership effectiveness.

Section 4

The real lives of CEOs

CEO salaries

Lastly, we thought it would be interesting to inquire about the lives of CEOs—including the kinds of questions we ponder but generally don’t have license to ask. Here’s what we found.

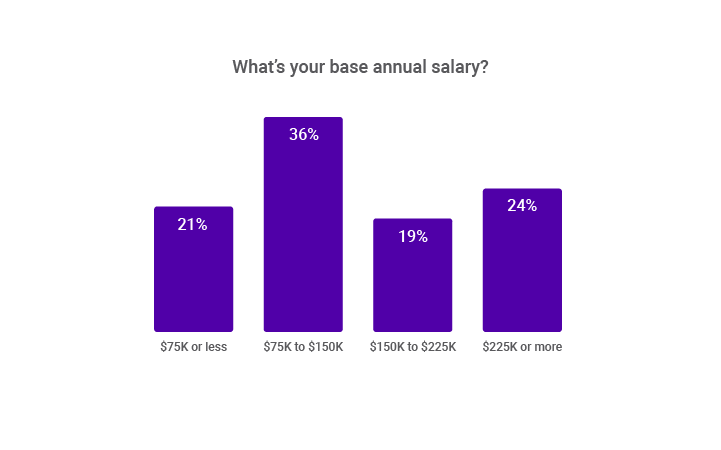

Let’s start with money. On the base salary front, the CEOs in our panel had a mean average annual salary of $178,454 and a median average annual salary of $149,000 (N=135; extreme outliers were excluded).

KEY FINDING

43 percent of CEOs earn a base annual salary of at least 150k.

Additional earnings potential

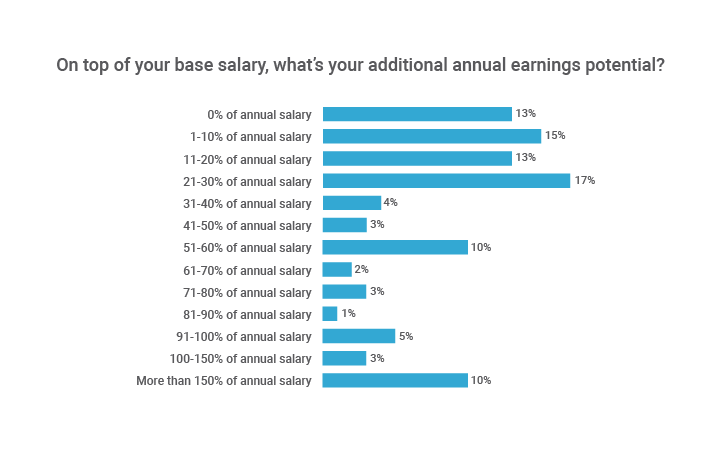

Next we asked the question: “On top of your base salary, what’s your additional annual earnings potential?” The vast majority of CEOs also had major additional annual earnings potential. Thirty-four percent could earn an additional 51 percent or more of their salary.

KEY FINDING

87 percent of CEOs have the potential to earn additional annual income.

Hours worked per week

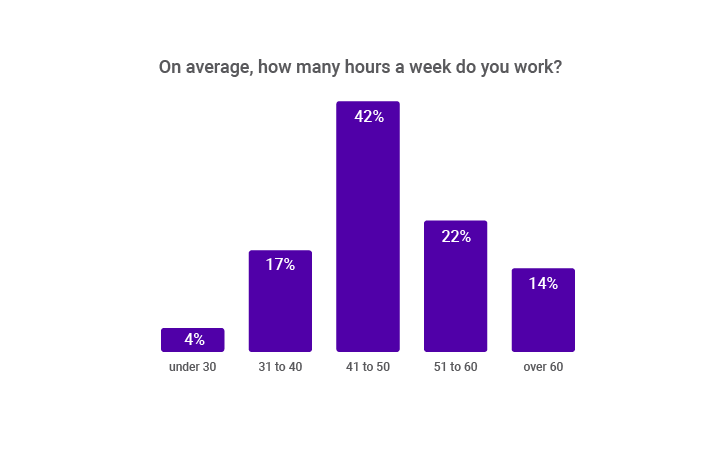

Not only did we gain a sense of how much they make, but we also learned a lot about how hard they work—or at least how many hours they work. The mean average: 50.01 hours per week.

KEY FINDING

42 percent work between 41 and 50 hours per week.

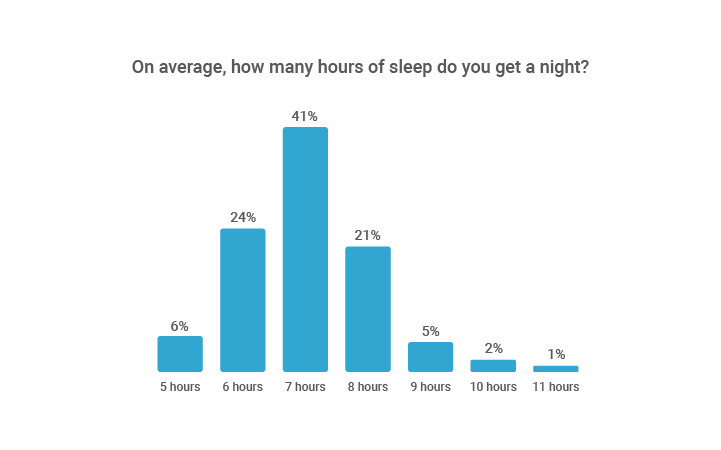

Hours of sleep per night

And are they getting sleep at night? On average, just a wink or two more than seven hours a night.

KEY FINDING

41 percent sleep for seven hours per night.

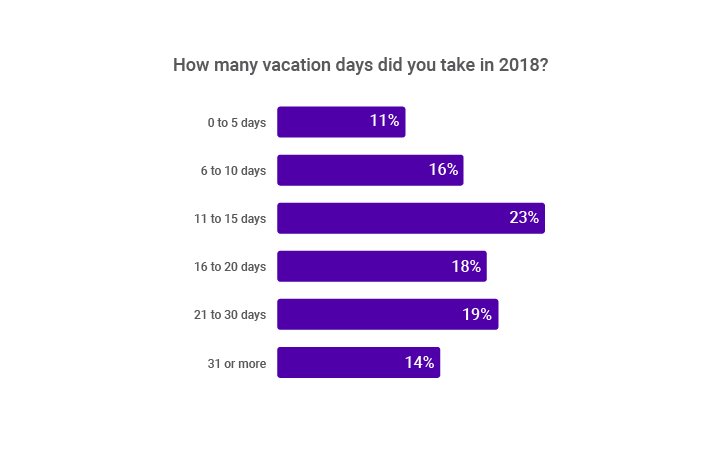

Vacation days per year

How do CEOs do when it comes to escaping the daily grind? The average amount of vacation time CEOs took in 2018 was 18.9 days.

KEY FINDING

CEOs take nearly 19 vacation days per year on average.

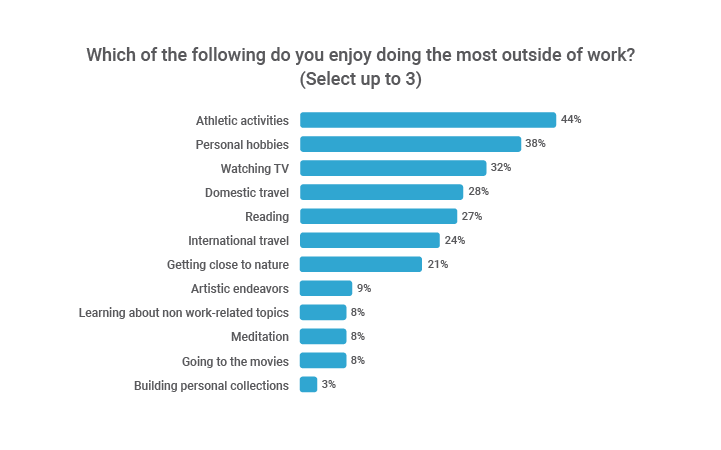

How they unwind

In addition to understanding how much vacation time they take, were were curious to know what CEOs to do unwind when they aren’t working. We asked them to identify their top three activities. The most popular choices: athletic activities, personal hobbies, and watching TV.

KEY FINDING

CEOs tend to enjoy sports; 44 percent participate in athletics when they’re not working.

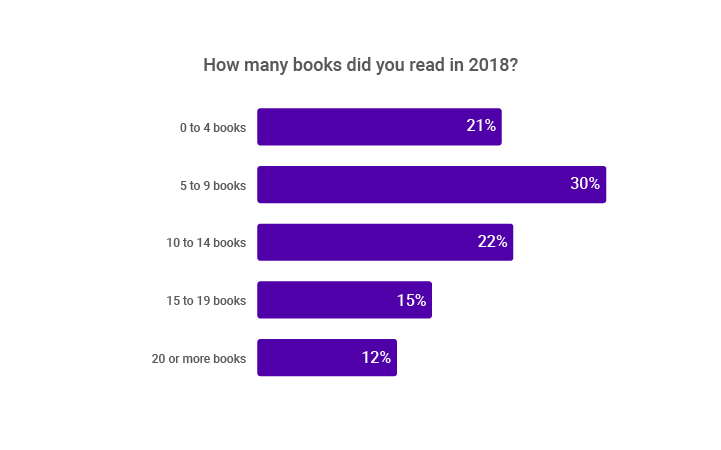

Reading habits

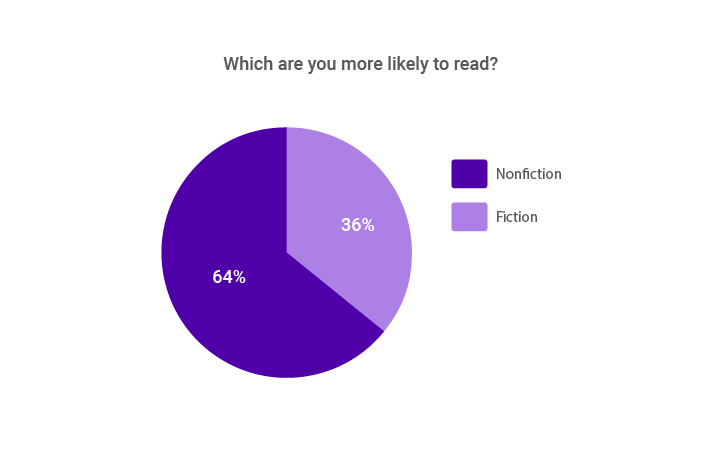

We wanted to learn how many books CEOs read (and what kind of reading they do). The average number of books these CEOs read in 2018 was 9.7—with a strong preference for non-fiction over fiction.

KEY FINDING

50 percent of CEOs read 10 or more books per year, and about two in three CEOs prefer to read nonfiction books.

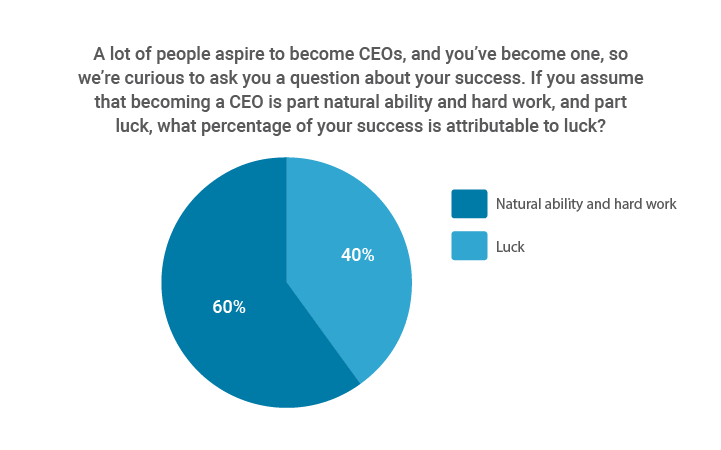

Natural ability vs. luck

Last but not least, we wanted to know how much CEOs attributed their career success to natural ability and hard work, and how much they attributed it to luck. On average, they reported it was 39.8 percent luck (and by inference, 60.2 percent natural abilities and hard work)

KEY FINDING

CEOs believe hard work trumps luck when it comes to becoming a CEO.

Section 5

Survey methodology

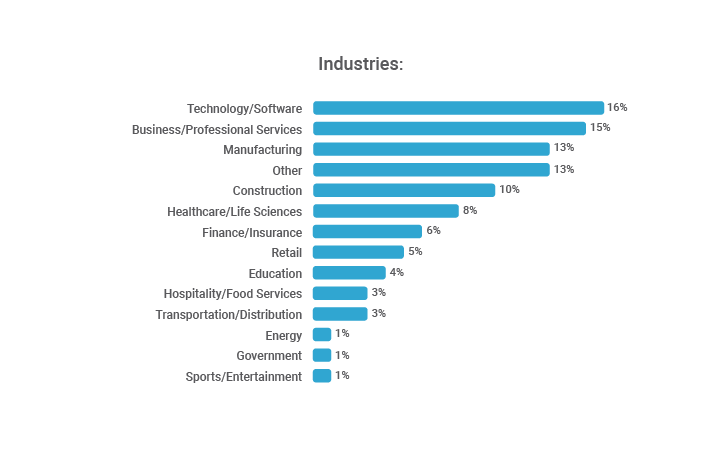

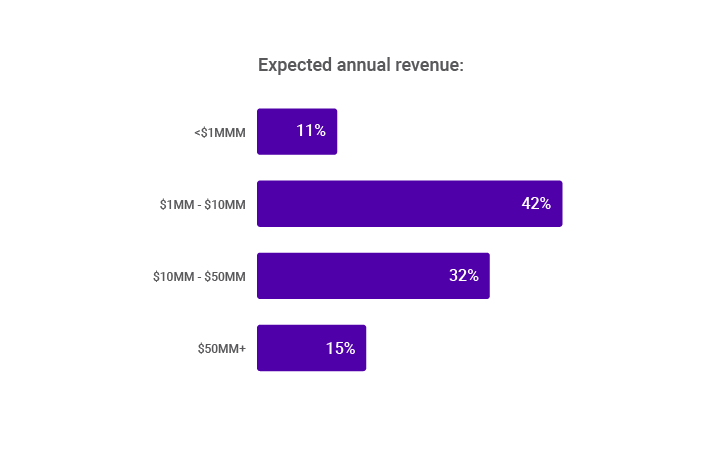

Survey methodology

In January 2019, The Predictive Index conducted a survey of company CEOs, presidents, and chairpeople. We secured respondents through three sources:

- Emails to those with the job title “CEO” or “Chief Executive Officer” in our existing contact database (both clients and prospects)

- Responses from CEOs via a panel provider called Critical Mix

- Through Respondent.io., which is a platform that connects researchers to reliable and credible respondents

Through those means, we collected 156 completed survey responses. Here is some information about the respondent pool:

NOTE:

Thad Peterson is the Sr. Director of marketing at The Predictive Index. He designed the CEO survey and produced this report.